indiana state tax warrants

The Indiana Department of Revenue DOR has the right under certain parameters to issue a tax warrant. Indiana warrants can be found online so instead of worrying if you have any Indiana outstanding warrants take the time and do a search.

The warrant can go to either a sheriff or collection agency.

. Our information is updated as often as every ten minutes and is. Grounds for indictment the importance of probable cause and the conditions for the issue of an arrest warrant are defined by section 35-33-2-1 of the Indiana Penal Code. It is simple to do and will only take a couple of minutes.

The site is very easy to use. The Clerks office has a public terminal that. Almost one third of Indiana counties were processing tax warrants manually when this project started.

Instead this is a chance to make voluntary restitution for taxes owed. Warrant types include individual business and workforce development where available. About Doxpop Tax Warrants.

Indiana State Tax Warrant Information. A tax lien in the state of Indiana is a judgment that occurs once a tax warrant is filed. The tax due Penalties assessed Interest assessed.

Tax Warrants are issued by written letter never by telephone. Then I worked six months in another state. Forty-two counties in the State of Indiana maintain judgment records on the INcite system which is maintained by the State.

My pension is from a company based in another state. The state programs to applications taken property to establish a garnishment action department of indiana tax warrant list by filing negligence penalties or wages and trip reports The IRS will withdraw their tax lien if the lien was filed prematurely or contain in accordance with IRS procedures IRS Form. The sheriff will collect your total balance which could include.

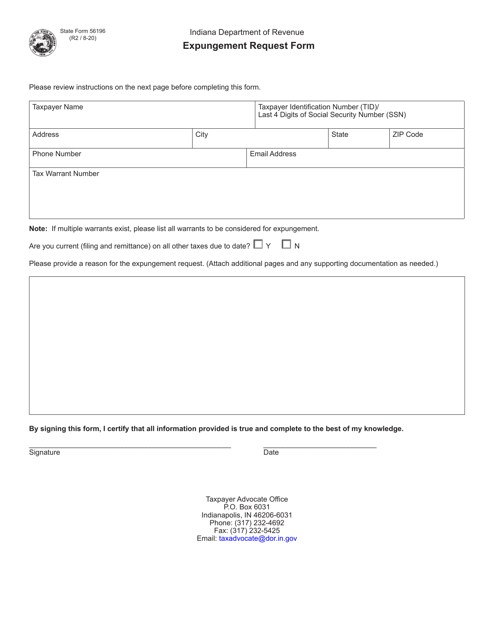

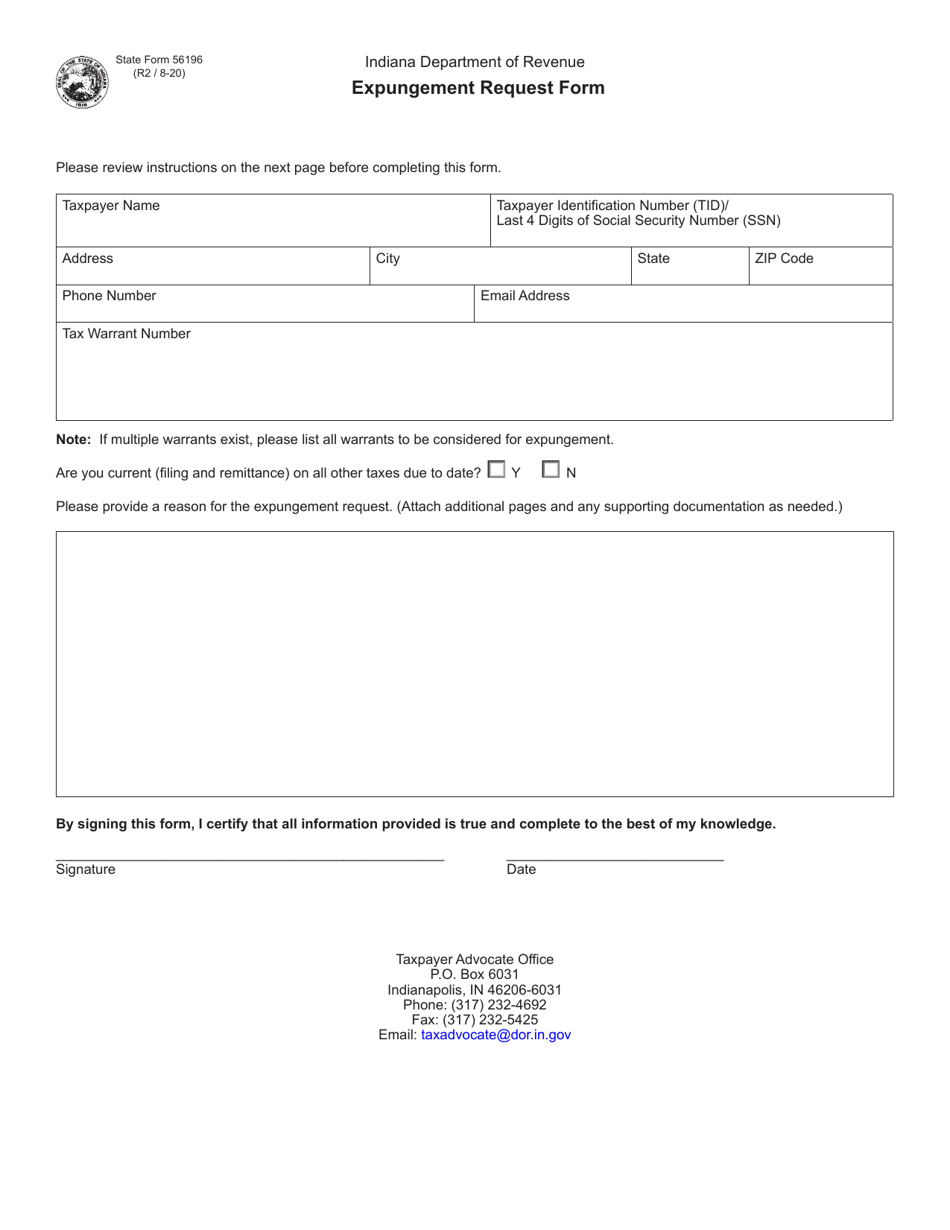

These should not be confused with county tax sales or a federal tax lien. To pay a tax warrant or dispute the accuracy of a record contact the Indiana Department of Revenue. Under IC 6-81-3 and IC 6-81-8-2 DOR will review requests for tax warrant expungements if the warrant was issued in error or the liabilities have been resolved and expunging the tax warrant may be in the best interest of the.

Tax warrants are filed when tax liabilities have not been paid and demand notices have generated neither a payment nor a protest. Just enter your name and see what comes back. What state is it taxed in.

Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR. Tax warrants create liens against property to collect unpaid taxes income or otherwise and are filed by the Department of Revenue DOR in the county. What is a tax warrant.

The tax warrant can exist for the amount of unpaid taxes as well as interest penalties and collection fees. The DOR also sends the Clerk a check for 300 for each tax warrant filed. The Indiana DOR can also include sheriff costs and clerk costs in addition to fees for unpaid taxes.

That process begins when the DOR mails tax warrants to Clerks who hand write the information in a Judgment Book and mail back filing information to the DOR. Ad 2022 Official Updated Database -Find All Warrants for Anyone. Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability.

The Indiana Department of Revenue first files a lien at the County Clerks Office then forwards a copy to this office. Indiana County Sheriffs are required by State Statute to collect delinquent State Tax. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to.

A tax warrant is threatening legal action. Pursuant to this law if an indictment is filed against a person and if he has not already been detained by the. A Tax Warrant is not an arrest warrant.

What can I do to be sure I am meeting all Indiana tax obligations for my business. Tax Warrants The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants. Ad Updated Find Arrest Warrants for Anyone - All States - Begin Free.

Indiana Tax Warrants System - ATWS Automated Tax Warrant System for Indiana Sheriffs Benefits of ATWS Built for Indiana Sheriffs Automatically generate notifications for the taxpayers Eliminates ALL data entry of tax warrant information ELIMINATES PINK SHEETS from the IDOR Allows for creation of payment plans for persons making payments. When you use one of these options include your county and warrant number. Indiana Warrant Search Outstanding Active Warrants in IN.

Tax Warrants The Indiana State Tax Warrants are downloaded to the Clerks Office computer system from the state level. Doxpop provides access to over current and historical tax warrants in Indiana counties. These taxes may be for individual income sales tax withholding or corporation liability.

The warrant is filed with all county clerks offices in which you have assets. Our service is available 24 hours a day 7 days a week from any location. We have been informed that some count clerks were back-dating the tax warrants entered into the records as of the date of assessment rather than the date of entry as required by state statute.

With a subscription to the Tax Warrant Application on INcite managed by the Office of Trial Court Technology users can get secure access to tax warrant information maintained by the Clerks of Court in 79 Indiana counties. Do not take chances. I worked in Indiana six months.

It means that the state.

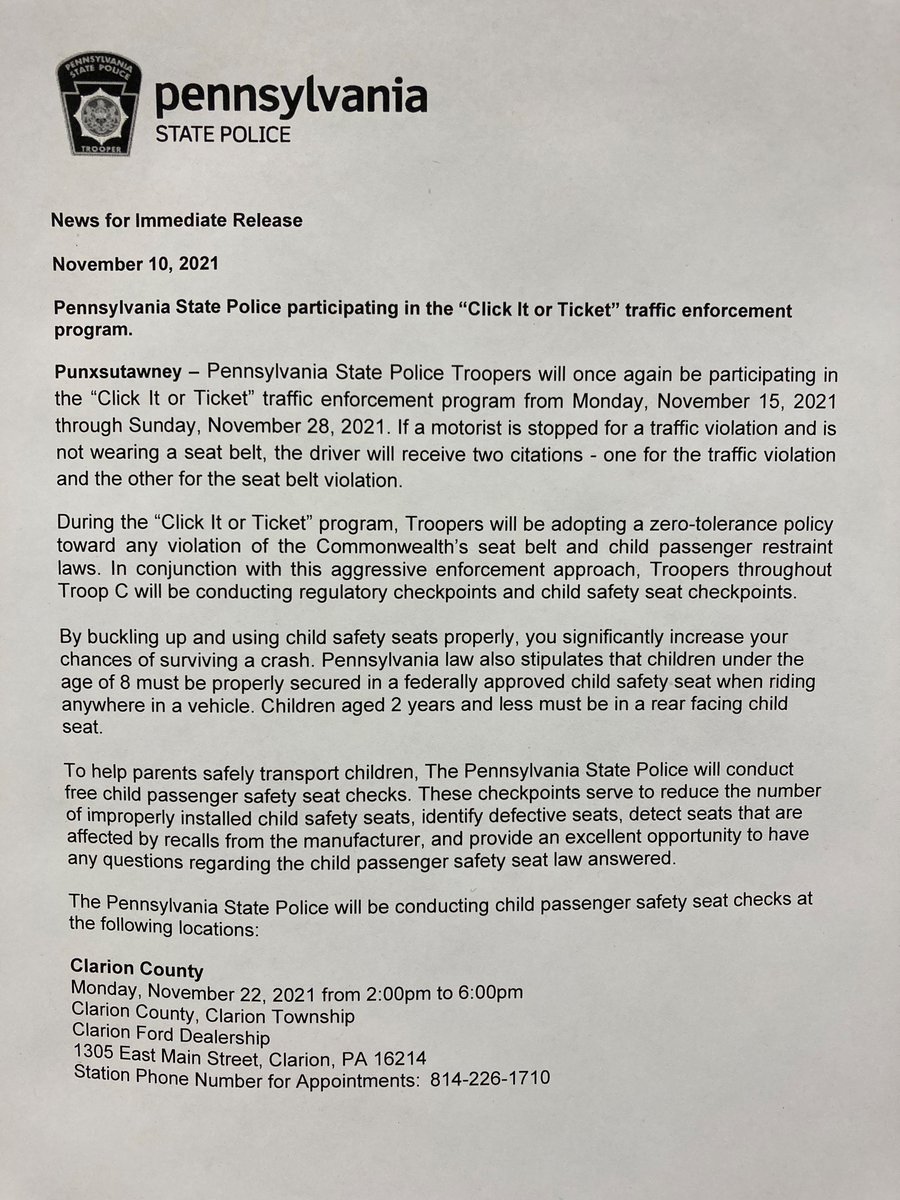

Trooper Bruce Morris Psptroopcpio Twitter

Trooper Bruce Morris Psptroopcpio Twitter

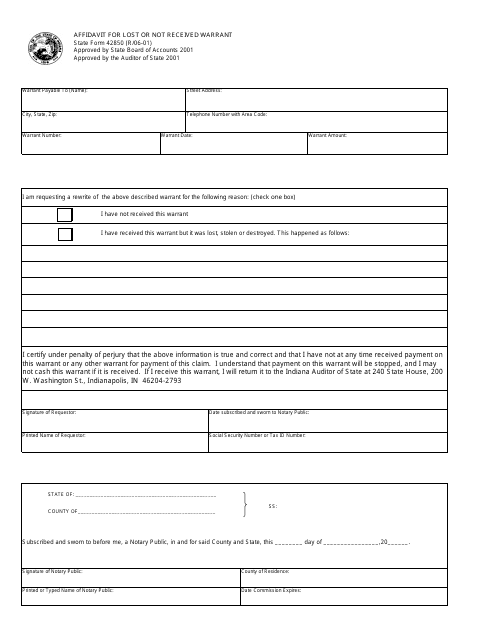

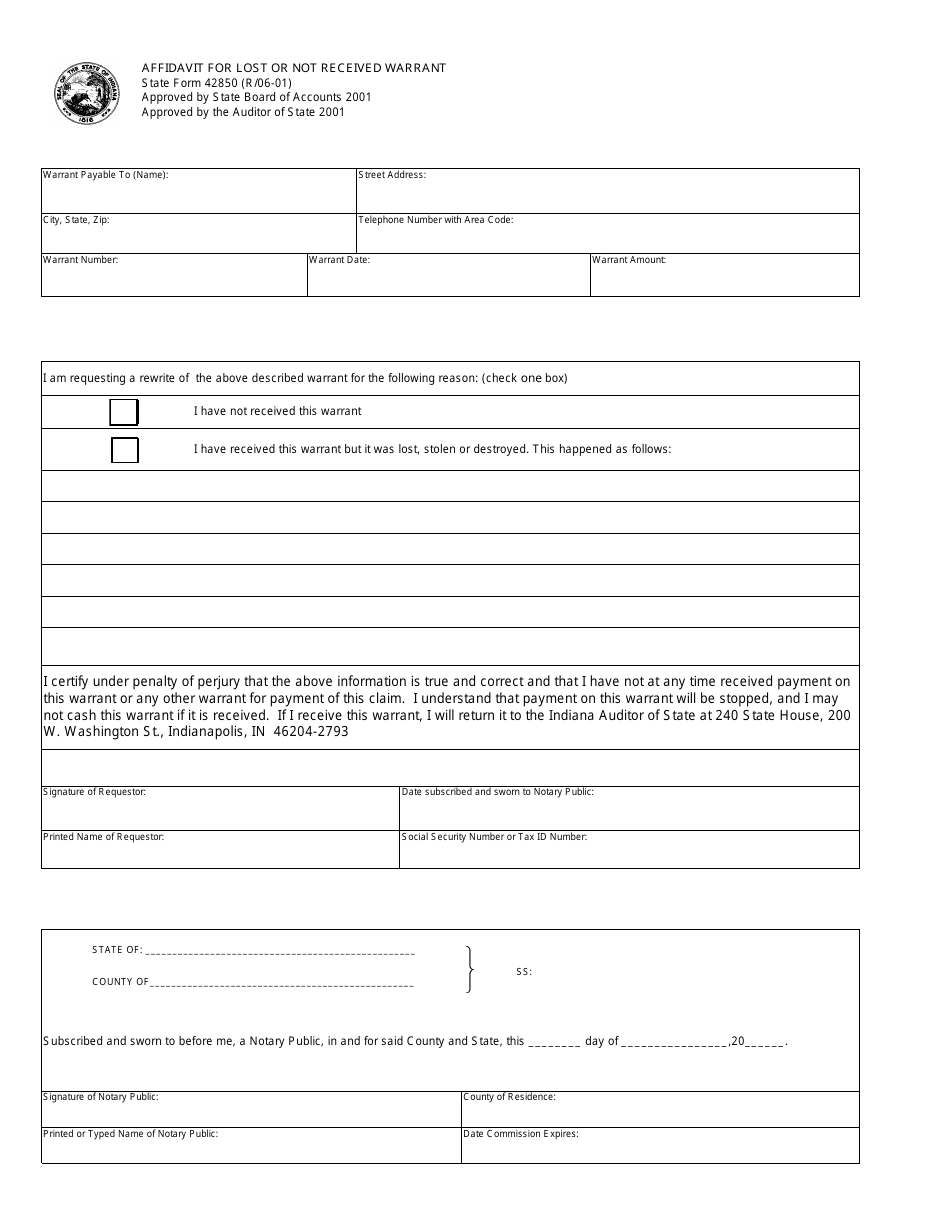

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org

Vanderburgh County Sheriff S D A R E Mustang Police Cars Emergency Vehicles Police

Trooper Bruce Morris Psptroopcpio Twitter

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Indiana Tax Anticipation Warrants An Option To Mitigate Short Term Cash Flow Shortages Baker Tilly

Why Is Inflation Bad Econlib How To Get Rich Risk Free Investments Savings And Investment

Irs Looking To Fill More Than 300 Positions In Kentucky Indiana And Ohio News Wdrb Com

Covid 19 Resources Indiana State Bar Association

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

State Recalls Tax Warrants Prior To Start Of Amnesty Program Wthr Com

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Scam Alert Letter Being Sent That Threatens Property Seizure If Taxes Aren T Paid